Next Batch:New batch starts every 7 days. Early registration is recommended.

Next Batch:New batch starts every 7 days. Early registration is recommended.

Course Duration:1–2 Months (Depending on schedule and batch size)

Course Duration:1–2 Months (Depending on schedule and batch size)

Eligibility:

Eligibility:

Tools:

Tools:

Modes of Training: Online Classes/Offline Training (at selected centers)

Modes of Training: Online Classes/Offline Training (at selected centers)

Projects:Available

Projects:Available

Average CTC

Naukri, LinkedIn, Glassdoor

Industry Mentors

The GST – Goods and Services Tax Course Certification is designed for accountants, business owners, and commerce students who want to master India’s indirect taxation system. This course provides complete knowledge of GST laws, compliance procedures, and practical return filing.

Learners get hands-on experience with GST registration, invoicing, and online return submission using the GST portal and accounting tools like Tally Prime. By the end of this program, you’ll earn your GST Certification, qualifying you for roles such as Tax Consultant, GST Executive, or Accountant in the finance industry.

Theory doesn’t help anyone in professional life, professional Courses are better learnt by experimenting.

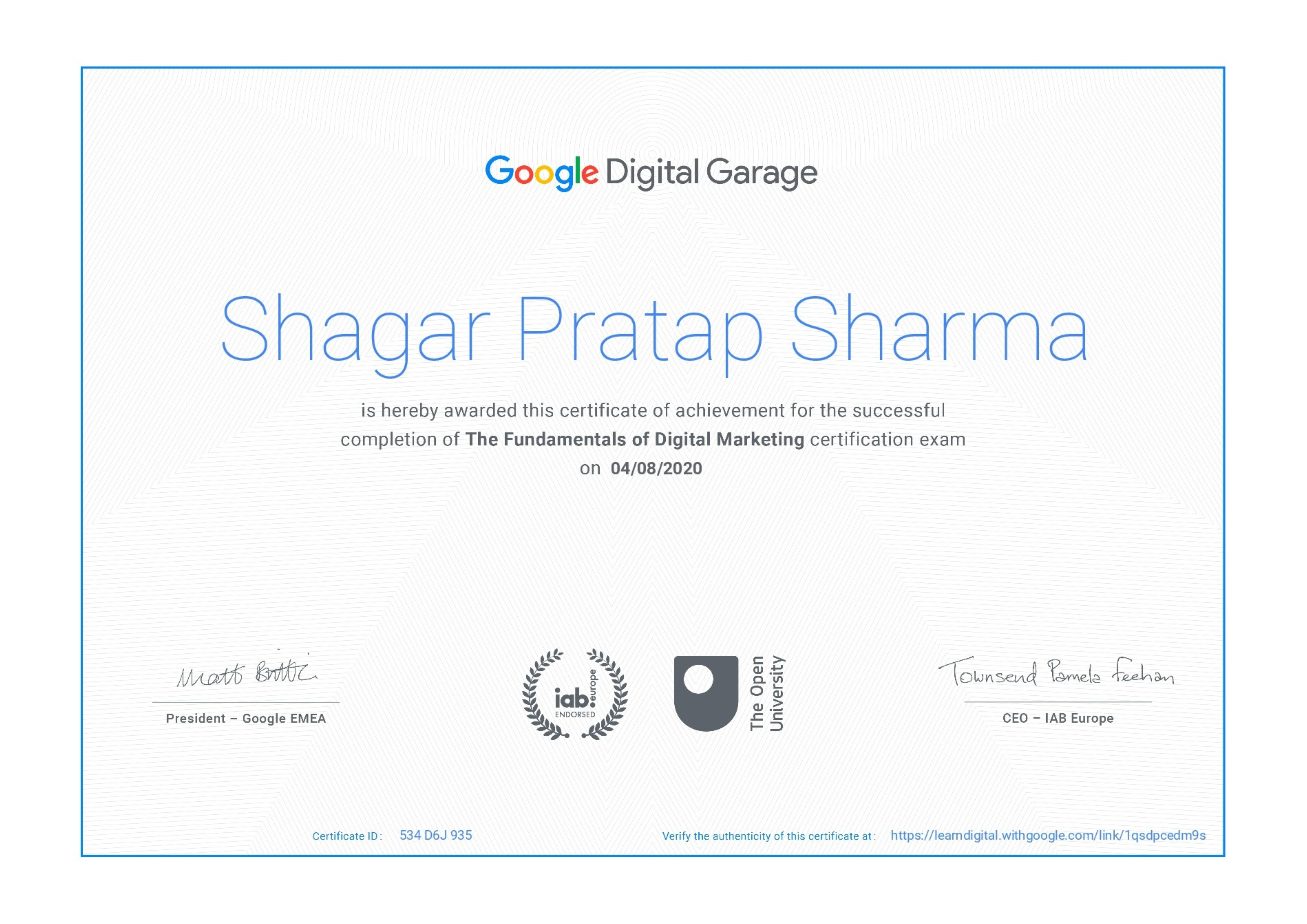

Certifications like Microsoft, Google, HP, Cisco, EC-Council make a huge difference in placement.

Contents are based upon the latest trends in IT industry nd as per the recommendations of IT Guys.

Good opportunities need to spread geographically, so is Samyak for the benefit of professional and job seekers.

All courses are as per industry needs and with projects/ examples, which make Samyak’s approach job oriented.

Once the course is completed from Samyak, there is a dedicated team to guide for interview and placements.

Learn skills that open doors to vast, growing markets worldwide, constantly increasing demand across industries.

Acquire in-demand expertise to command top salaries, and accelerate long-term financial growth .

Build adaptable, technology that keep your career relevant, and valuable in changing times.

Gain practical tools, mindset and networks needed to launch ventures, create sustainable businesses.

Develop solutions and leadership that solve real-world problems, positively impacting communities.

Join a diverse, supportive community of learners, mentorship, opportunities, and lasting connections.

A detailed overview of the course, including key topics, objectives, and module sequence.

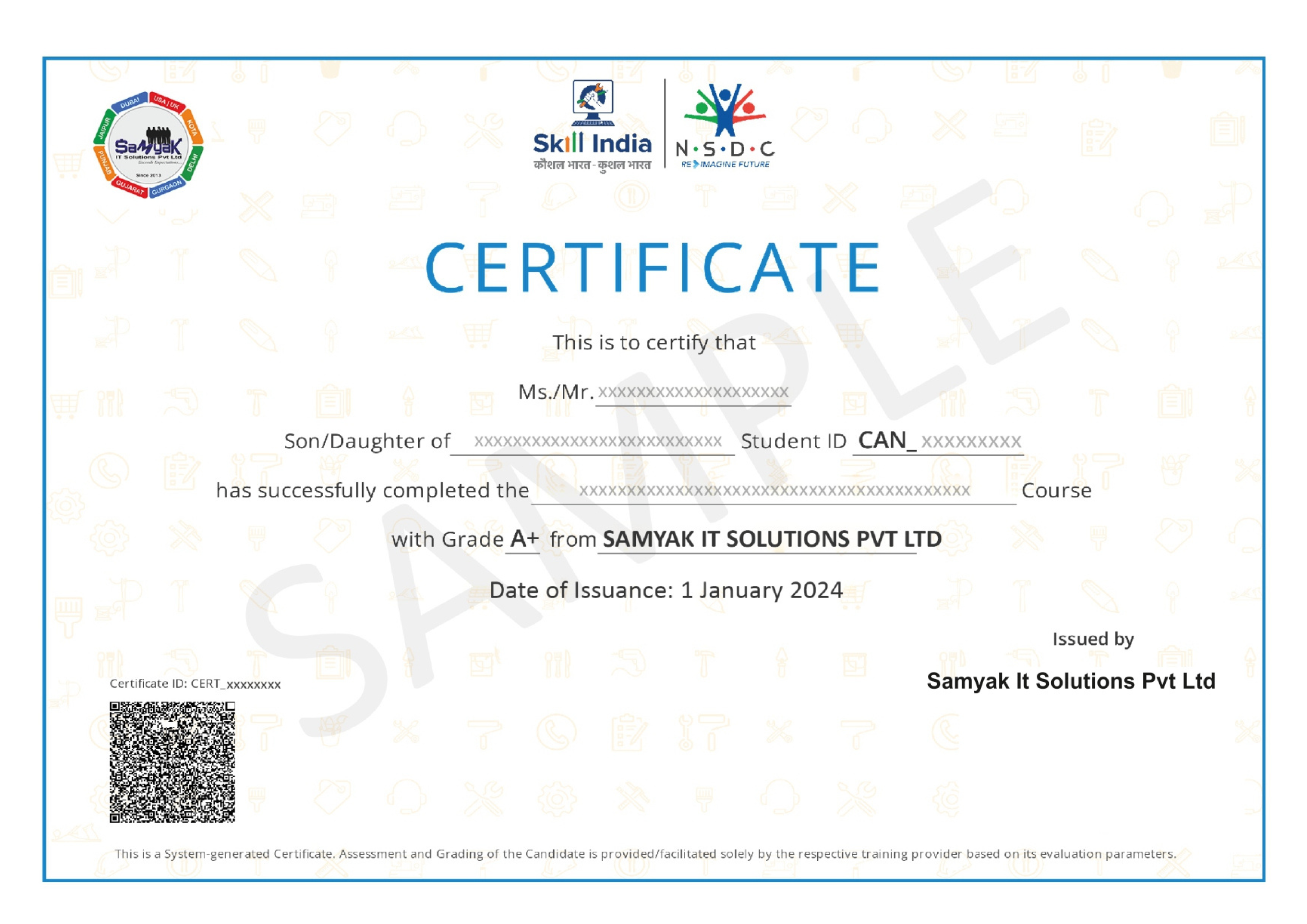

Internationally recognized certificate for professional achievement.

ISO 9001:2008 certified training recognized globally.

Govt of India-backed certification enhancing employability.